The Ultimate Overview to Finding the Best Hard Cash Lenders

From examining lending institutions' credibilities to contrasting interest prices and costs, each action plays an important role in safeguarding the finest terms feasible. As you think about these variables, it becomes noticeable that the course to determining the appropriate tough money lender is not as straightforward as it might appear.

Recognizing Difficult Cash Fundings

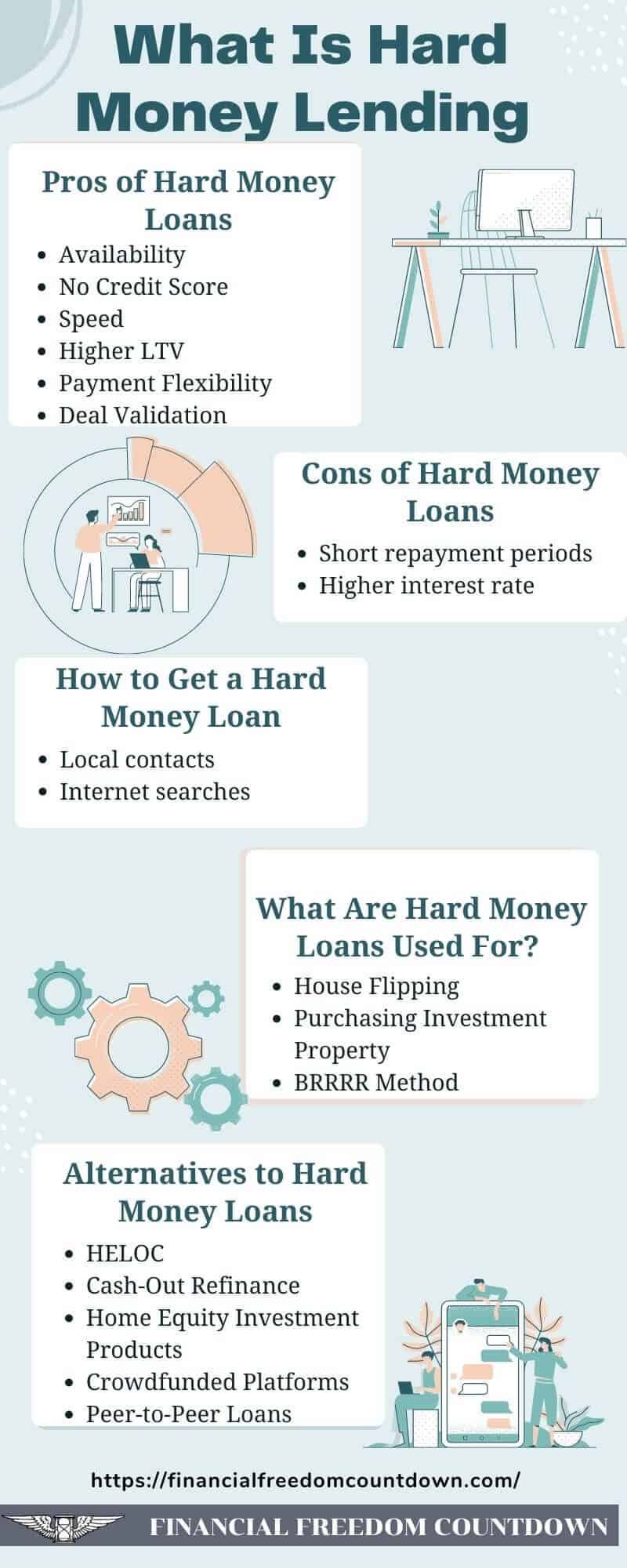

Comprehending tough cash finances entails recognizing their one-of-a-kind features and purposes within the actual estate financing landscape. These finances are typically protected by realty and are used by exclusive loan providers or investment teams, differentiating them from standard home loan products given by financial institutions or cooperative credit union. Hard money fundings are largely utilized for short-term funding needs, commonly facilitating quick purchases for real estate investors or designers who need instant capital for residential or commercial property procurement or restoration.

Among the defining features of tough money lendings is their dependence on the value of the residential property rather than the customer's creditworthiness. This permits consumers with less-than-perfect credit or those looking for expedited funding to gain access to capital quicker. In addition, tough money fundings typically feature greater rate of interest and much shorter payment terms contrasted to standard financings, reflecting the raised threat taken by lending institutions.

These finances offer various purposes, consisting of financing fix-and-flip projects, refinancing distressed buildings, or giving resources for time-sensitive opportunities. Recognizing the nuances of tough cash lendings is vital for investors who aim to take advantage of these economic tools efficiently in their genuine estate ventures - ga hard money lenders.

Trick Aspects to Think About

When reviewing difficult cash lenders, what crucial variables should be prioritized to ensure a successful purchase? Examine the loan provider's reputation. Research their background, consumer testimonials, and total integrity within the property investment neighborhood. A trusted lender needs to have a tested track document of pleased customers and successful offers.

Next, consider the regards to the loan. Various loan providers use differing rate of interest prices, charges, and payment schedules. It is critical to comprehend these terms totally to prevent any kind of undesirable shocks later on. Additionally, check out the lender's financing rate; a swift authorization process can be important in open markets.

One more essential variable is the loan provider's experience in your specific market. A loan provider knowledgeable about neighborhood conditions can supply important understandings and could be more versatile in their underwriting procedure.

Exactly How to Examine Lenders

Assessing tough money loan providers involves a methodical approach to guarantee you select a companion that aligns with your financial investment objectives. Start by analyzing the lending institution's credibility within the sector. Look for evaluations, endorsements, and any available scores from previous customers. A credible lending institution should have a history of effective transactions and a strong network of completely satisfied borrowers.

Following, examine the lender's experience and specialization. Different loan providers may focus on different sorts of buildings, such as residential, industrial, or fix-and-flip jobs. Select a loan provider whose expertise matches your financial investment approach, as this expertise can substantially impact the authorization procedure and terms.

An additional essential variable is the lender's responsiveness and interaction style. A reputable loan provider ought to be ready and accessible to address your concerns comprehensively. Clear interaction throughout the evaluation process can show just how they will certainly manage your lending throughout its duration.

Finally, make sure that the lender is clear regarding their processes and needs. This consists of a clear understanding of the documents required, timelines, and any kind of conditions that may apply. Taking the time to review these elements will equip you to make an informed decision when picking a difficult money lender.

Comparing Rate Of Interest and Costs

A complete comparison of rates of interest and fees among tough money loan providers is important for optimizing your financial investment returns - ga hard money lenders. Hard money lendings commonly come with higher rates of interest compared to typical financing, normally ranging from 7% to 15%. Comprehending these prices will certainly help you assess the possible costs connected with your financial investment

In enhancement to interest rates, it is essential to review the connected charges, which can dramatically impact the overall finance price. These fees may include origination costs, underwriting fees, and closing costs, usually expressed as a portion of the finance quantity. For example, source costs can vary from 1% to 3%, and some lenders may bill additional fees for processing or administrative jobs.

When contrasting lending institutions, take into consideration the complete cost of loaning, which incorporates both the passion prices and charges. This alternative technique will certainly enable you to determine the most affordable options. Additionally, be sure to inquire regarding any kind of possible early repayment charges, as these can affect your capacity to pay off the financing early without incurring added costs. Ultimately, a mindful evaluation of interest prices and charges will lead to check my source more informed loaning choices.

Tips for Successful Loaning

Following, prepare a detailed business strategy that details your job, expected timelines, and financial estimates. This shows to loan providers that you have a well-balanced method, improving your trustworthiness. Additionally, keeping a solid relationship with your loan provider can be helpful; open communication fosters trust fund and can cause much more desirable terms.

It is likewise necessary to make sure that your check it out residential property meets the lending institution's requirements. Conduct a comprehensive assessment and offer all needed documentation to simplify the approval procedure. Be conscious of departure strategies to repay the car loan, as a clear repayment strategy comforts lending institutions of your commitment.

Conclusion

Additionally, difficult money loans normally come with higher passion rates and much shorter repayment terms contrasted to traditional loans, mirroring the enhanced threat taken by loan providers.

When reviewing difficult money lenders, what vital aspects should be focused on to guarantee an effective transaction?Examining hard money lending institutions involves a systematic approach to guarantee you choose a companion that aligns with your financial investment objectives.An extensive contrast of interest rates and costs among difficult money loan providers is essential for maximizing your financial investment returns. ga hard money lenders.In recap, locating the ideal difficult cash lending institutions necessitates a detailed examination of different aspects, consisting of loan provider online reputation, lending terms, and expertise in property types